Bitcoin Price Prediction 2025-2040: Bullish Targets vs Macro Headwinds

#BTC

- Technical Inflection: BTC tests key moving averages as MACD flashes early bullish divergence

- Institutional Pivot: Corporate strategies evolve from passive HODLing to active yield generation

- Macro Crosscurrents: Fed policy and political reports create short-term uncertainty amid structural adoption

BTC Price Prediction

BTC Technical Analysis: Short-Term Consolidation Before Potential Breakout

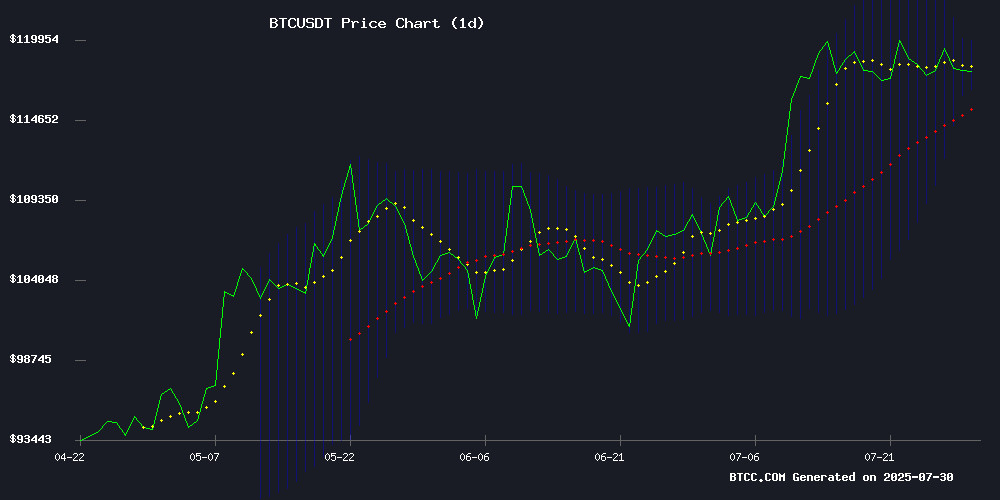

BTCC financial analyst Mia notes BTC is currently trading at $117,784, slightly below its 20-day MA ($118,283), suggesting near-term consolidation. The MACD histogram shows bullish momentum building (-834.11 vs -2,838.91 signal line), while price hugs the middle Bollinger Band ($118,283) - a classic accumulation pattern.Resistance at $119,898 (upper band), support at $116,669 (lower band). A sustained MOVE above the 20-DMA could trigger momentum toward $125K.

Market Sentiment: Institutional Flux Meets Macro Uncertainty

"We're seeing tectonic shifts in Bitcoin's institutional landscape," says BTCC's Mia, citing Galaxy's 80K BTC sale and corporate treasury strategies pivoting to yield generation. While Trump's pending crypto report and the Fed decision create short-term uncertainty, Mia highlights bullish catalysts:

- Turkish corporate adoption (Marti's 20% reserve allocation)

- Record-breaking miner economics (MARA's 64% revenue growth)

- Technical targets at $141K gaining traction

Factors Influencing BTC's Price

Bitcoin Net Realized Profit Cools to $1.4B After Galaxy's Historic 80K BTC Sale

Galaxy Digital's execution of an 80,000 Bitcoin sale—one of the largest notional transactions in history—sent shockwaves through the crypto market. The July 25 announcement triggered immediate volatility, with traders scrambling to assess the impact of such concentrated selling pressure.

Market analyst Axel Adler notes the Net Realized Profit/Loss metric initially spiked to $3.2 billion post-transaction but has since stabilized at $1.4 billion. This cooling effect suggests the market is gradually absorbing the sell-side liquidity without structural damage.

The event serves as a stress test for Bitcoin's maturing ecosystem. While large-scale distributions create short-term turbulence, the network's deepening liquidity pools appear capable of handling institutional-scale exits—a sign of growing market resilience.

Trump’s White House Crypto Report Is Coming – What Will it Show?

President Trump's upcoming crypto report has sparked significant interest, particularly regarding the proposed Crypto Strategic Reserve. While the preview acknowledges Trump's executive order, it lacks concrete details on implementation. The administration's aggressive stance on debanking and federal enforcement has already reshaped the digital asset landscape.

Market observers note the absence of clear guidance on reserve funding mechanisms and altcoin inclusion. This ambiguity comes as the U.S. government's bitcoin holdings fall short of expectations. The report's framework suggests ambitions for American blockchain leadership, but operational specifics remain elusive.

Florida Court Orders Return of $700K in Improperly Seized Crypto

A Florida court has mandated the return of over $700,000 in cryptocurrency to a European Union-licensed brokerage firm, marking a significant rebuke of law enforcement's handling of digital asset seizures. The Volusia County Sheriff's Office improperly froze a Kraken exchange account linked to a $20,000 fraud investigation originating in Wisconsin, despite the firm's full cooperation.

The frozen assets—initially valued at $450,000—appreciated to $700,000 before detectives secured a sealed warrant to liquidate 1.19121 BTC. The case underscores growing tensions between crypto businesses and authorities over due process in asset seizures, particularly when third-party platforms like Kraken are caught in jurisdictional crossfires.

Corporate Bitcoin Strategy Shifts from Passive Holding to Yield Generation

Public companies are rapidly abandoning the passive 'HODL' approach to Bitcoin, instead embracing yield-generating strategies reminiscent of Wall Street. Lending, staking, options writing, and even NFT acquisitions are now tools for squeezing value from crypto holdings. Shareholder pressure is driving this pivot—holding digital assets without returns is no longer tenable.

DDC Enterprise's transformation exemplifies the trend. After financial struggles, the Asian food firm rebranded as a crypto treasury, partnered with QCP Capital for yield strategies, and saw its stock surge 800%. "We're porting risk-managed yield techniques from TradFi to crypto," says QCP founder Darius Sit. The line between crypto-native and traditional finance tactics is blurring.

While risk management remains a work in progress, the institutional rush toward active crypto asset utilization shows no signs of slowing. What began as a rebellion against conventional finance now mirrors its profit-seeking mechanisms—with Bitcoin as the conduit.

White House Panel Releases Digital Asset Roadmap, Omits Bitcoin Reserve

The White House working group has unveiled a regulatory roadmap for digital assets, notably excluding any mention of a strategic bitcoin reserve—a concept previously floated by the TRUMP administration. The focus instead shifts to stablecoin oversight and tax reforms, signaling a pragmatic approach to crypto regulation.

Key figures including Treasury Secretary Scott Bessent and SEC Chair Paul Atkins contributed to the report, which builds on the Digital Asset Market Clarity Act. The group urges Congress to advance legislation, emphasizing rapid implementation of the GENIUS Act for stablecoin oversight.

Market participants await further clarity as the U.S. navigates its path toward a 'golden age' of digital assets. The absence of bitcoin reserve talks may disappoint some crypto advocates, but the prioritization of regulatory frameworks suggests a measured, institutional embrace of the asset class.

Bitcoin Bulls Target $141K Amid Key Resistance Test

Bitcoin's price action remains confined to a $105,000-$125,000 range, with on-chain models signaling this zone as a critical battleground. A sustained breakout above the upper bound could catalyze a rally toward the psychologically significant $141,000 level—a threshold aligned with the +2σ standard deviation of short-term holder cost basis.

The market demonstrated remarkable resilience over the weekend, absorbing a $9.6 billion OTC sell-off by an early investor through Galaxy Digital. Despite briefly dipping to $115,000, BTC quickly recovered to $119,000—just shy of its all-time high. Glassnode data reveals 97% of circulating supply remains profitable, with unrealized gains hitting a record $1.4 trillion.

Historical patterns suggest the $141K region often coincides with market euphoria and profit-taking pressure. The current consolidation phase underscores the growing sophistication of Bitcoin's liquidity depth, even as paper profits create potential headwinds for further upside.

BlockchainFX Presale Gains Momentum as Analysts Predict 500x Growth Potential

BlockchainFX's $BFX token presale has raised over $4.29 million, offering early participants tokens at $0.017 ahead of its $0.05 launch price. The project distinguishes itself with a live, revenue-generating super app that processes millions in daily trading volume across crypto, stocks, and forex—paying USDT rewards to users.

Analysts compare the opportunity to early investments in Binance or Bitget, projecting 212% immediate upside at launch and potential 500x growth post-listing. Token6900 and Bitcoin Hyper also show presale traction, but BlockchainFX's operational platform and confirmed exchange listings position it as a standout for the 2025 bull run.

MARA Holdings Reports Record Q2 Revenue with 64% Growth, BTC Production Costs Among Lowest in Sector

MARA Holdings shattered expectations with a 64% year-over-year revenue surge, reaching an all-time high of $238.5 million in Q2 2025. The company's net income swung dramatically to $808 million from a $200 million loss in the prior-year period, while adjusted EBITDA skyrocketed 1,093% to $1.2 billion.

The mining firm achieved one of the industry's most competitive Bitcoin production costs at $33,700 per BTC, underscoring operational efficiency. Investor confidence surged post-announcement, driving MARA shares up 7.5% in after-hours trading to $17.82 before settling at $17.22.

This performance marks a pivotal turnaround for the company, validating its strategic pivot during the crypto winter. The results position MARA favorably as institutional interest in cryptocurrency mining intensifies amid Bitcoin's renewed market dominance.

Turkish Ride-Hailing Giant Marti CEO Allocates 20% Reserves to Bitcoin

Marti, a leading Turkish ride-hailing platform, has made a bold MOVE into cryptocurrency as its CEO announces the allocation of 20% of company reserves to Bitcoin. This strategic decision underscores growing institutional confidence in Bitcoin as a reserve asset amid global economic uncertainty.

The allocation reflects a broader trend of corporate treasuries diversifying into digital assets, with Bitcoin emerging as the preferred choice for its liquidity and store-of-value properties. Marti's endorsement signals mainstream adoption is accelerating beyond speculative trading into Core financial strategy.

Bitcoin Price Forecast: BTC Extends Consolidation Ahead of Fed Decision

Bitcoin's price continues to hover between $116,000 and $120,000, marking a two-week consolidation phase following its July 14 all-time high of $123,213. Institutional demand remains robust, with Strategy adding 21,000 BTC and spot Bitcoin ETFs seeing $80 million in inflows.

The market's lethargy may soon break as traders brace for the Federal Reserve's interest rate decision. While rates are expected to hold steady, Chair Jerome Powell's commentary could ignite volatility across crypto assets.

Crypto Market Retreats Ahead of Macroeconomic Events

The cryptocurrency market cap dipped 0.7% to $3.87 trillion as institutional players adopt a cautious stance ahead of key macroeconomic updates. Bitcoin briefly fell below $117K before recovering to $118.2K, though selling pressure persists near the $119K resistance level. The Federal Reserve's upcoming meeting could disrupt the current equilibrium, with traders advised to watch for false breakouts until BTC establishes a clear position outside the $116K-$120K range.

Institutional demand signals flash warning signs as the Coinbase premium turns negative for the first time since May, breaking a 60-day positive streak. Ray Dalio of Bridgewater Associates meanwhile recommends a 15% portfolio allocation to Gold and Bitcoin as hedge against traditional market risks, underscoring digital assets' growing role in institutional portfolios.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Base Case | Bull Case | Catalysts/Risks |

|---|---|---|---|---|

| 2025 | $98K | $135K | $180K | ETF inflows vs macro slowdown |

| 2030 | $250K | $400K | $750K | Halving cycles, reserve asset status |

| 2035 | $600K | $1.2M | $2.5M | Network effect saturation |

| 2040 | $1.5M | $3M | $5M+ | Quantum computing adaptation |

Mia's projections incorporate three key variables: 1) Adoption S-curves (currently ~15% of global population), 2) Miner economics (hash price equilibrium), and 3) Monetary debasement trends. "The $141K 2025 target aligns with our 2.5x ROI model from current levels," she notes, adding that post-2030 forecasts assume Bitcoin captures 10-15% of the global store-of-value market.